georgia ad valorem tax refund

Vehicles purchased on or after March 1 2013. Multiply the vehicle price before trade-in or incentives by the sales tax fee.

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

This tax is based on the value of the vehicle.

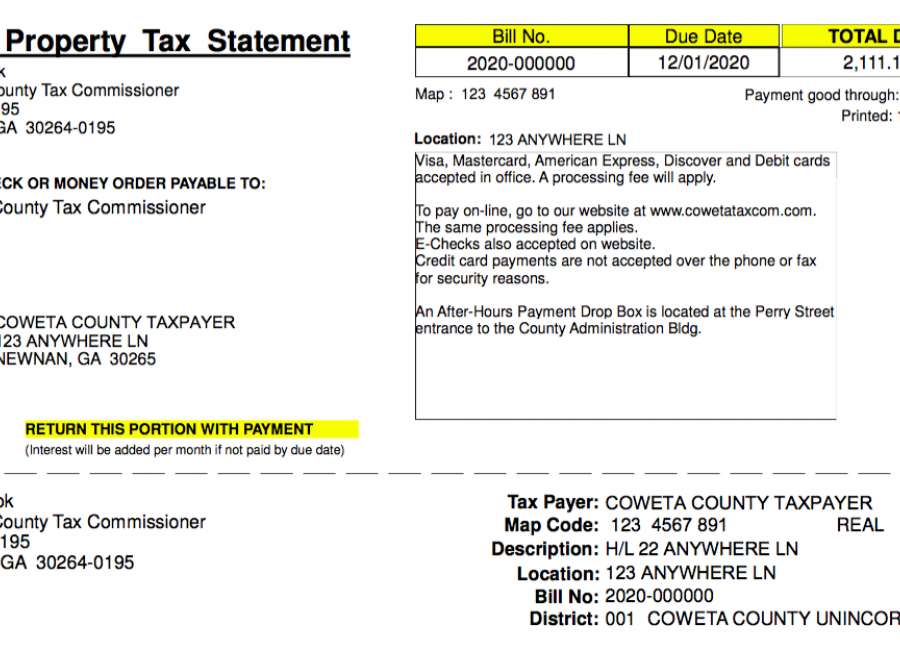

. It is important for property owners to understand the tax and billing process since tax bills constitute a lien on the property on January 1st of each year. Ad valorem tax more commonly known as property tax is a large source of revenue for governments in Georgia. Quick Links Georgia Tax Center.

The TAVT rate will be lowered to 66 of the. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Request an additional six months to file your Georgia income tax return.

Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. The minimum is 725. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those.

Income Tax Refunds Learn about income taxes and tracking tax refunds. Georgia Department of Revenue March 1 2013 Titled motor vehicle purchased on or after March 1 2013. The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system.

For example imagine you are purchasing a vehicle. Also refer to Regulation 560-3-2-27 Signature Requirements for Tax Returns. A refund complete an Application for Refund of Ad Valorem Taxes Form DR-462 and submit it.

The tax is levied on the assessed value of the property which by law is established at 40 of fair. Track a Tax Refund. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction.

If a vehicle is used for business the title tax should be added to the cost basis like a sales tax. How does TAVT impact vehicles that are leased. The two changes that apply to most vehicle transactions are.

Learn how Georgias state tax laws apply to you. The information on this page is intended to proved some basic information on the treatment of real estate taxes also known as ad valorem taxes in Georgia. For the answer to this question we consulted the Georgia Department of Revenue.

Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. Ad valorem tax more commonly known as property tax is a large source of revenue for local governments in Georgia. Learn how Georgias state tax laws apply to you.

The family member who is titling the vehicle is subject to a 05 title ad valorem tax. This ad valorem tax is deductible each year. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT.

Related Topics Ad Valorem Vehicle Taxes. The tax is levied on the assessed value of the property which by law is established at 40 of the fair market. Some of the taxes levied may not be collected for various reasons assessment errors insolvency bankruptcy etc.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

The basis for ad valorem taxation is the fair market value of the property which is established January 1 of each year. The basis for ad valorem taxation is the fair market value of the property which is established as of January 1 of each year. This tax is based on the value of the vehicle.

This calculator can estimate the tax due when you buy a vehicle. Related Agency Department of Revenue. If itemized deductions are also.

The property taxes levied means the taxes charged against taxable property in this state. Using the IRS requirements Georgia will permit paid preparers to sign original returns amended returns or requests for filing extensions by rubber stamp mechanical device such as signature pen or computer software program. For vehicles purchased in or transferred to Georgia prior to 2012 there is still an ad valorem tax assessed annually and based on the value of the vehicle.

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles.

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Keep An Eye On Your Mailbox Georgia Is Issuing Refunds To Many Georgia Taxpayers Rybd Advisors Accountants

Property Overview Cobb Tax Cobb County Tax Commissioner

Property Tax Bills On Their Way The Newnan Times Herald

Georgia Department Of Revenue To Begin Issuing Special One Time Tax Refunds The Georgia Virtue

Income Tax Refunds Georgia Gov

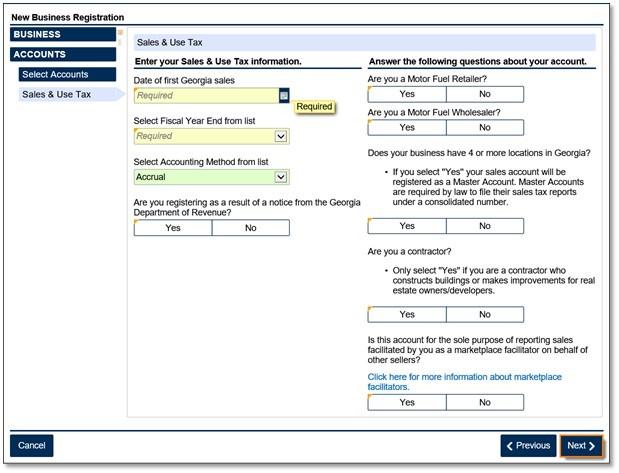

Marketplace Facilitators Georgia Department Of Revenue

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia

Chatham County Ga Hallock Law Llc Property Tax Appeals

Georgia Department Of Revenue Fayette County Local Ad Valorem

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Income Tax Refunds Georgia Gov

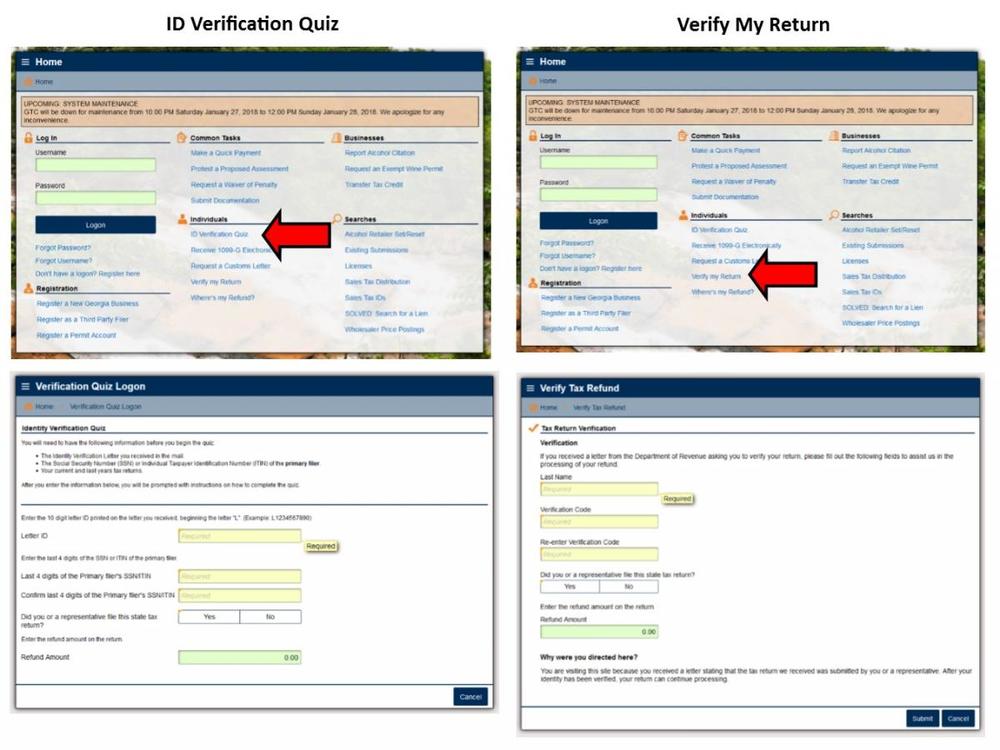

Return Verification Id Verification Quiz Georgia Department Of Revenue